About the Company

An US Regional Bank in the North East.

Background of Business Problem

- The Regional Bank aimed to expand its customer base through a resilient Rewards Program but faced limitations.

- These included rigidity in the offerings that were unable to adapt to rapidly changing market dynamics, rewards programs that lacked the appeal needed to attract and retain customers in a competitive landscape, and offerings that were not aligned with evolving consumer preferences.

- Additionally, integrating multiple accounts, loyalty points, and diverse payment sources posed significant scalability challenges.

- To overcome these obstacles and revitalize its Rewards Program, the bank embarked on a strategic initiative to develop a sophisticated programmable payment engine.

- This engine aimed to enhance flexibility, improve customer engagement through personalized rewards, and streamline the management of loyalty points and payment integrations, ultimately positioning the bank as a leader in customer-centric financial services.

Our Approach & Solution

Infinite team used its payments expertise to architect & develop an agnostic integration solution and supported the Bank to roll-out the program to new channels.

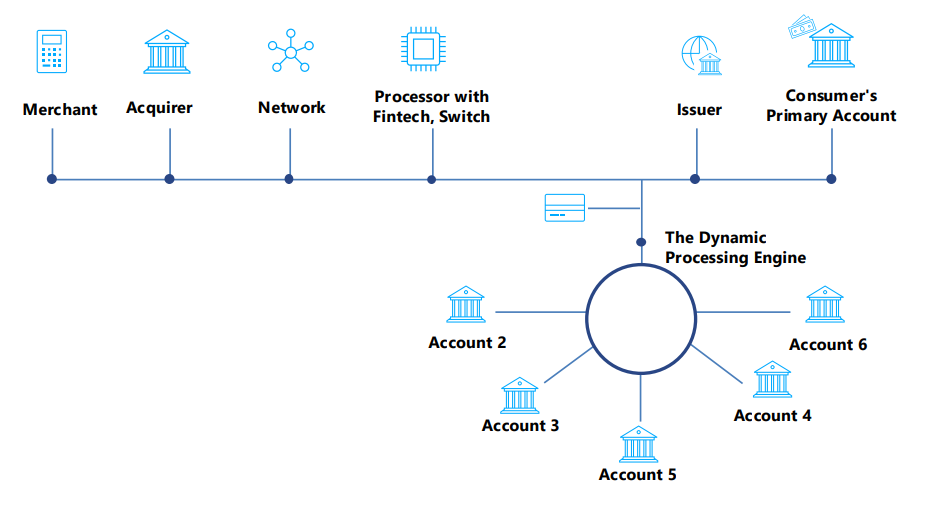

Infinite developed an advanced Programmable Payments switch processor, which was seamlessly integrated with multiple payment channels.

This integration led to the successful onboarding of 1900+ new merchants and a notable increase in customer base.

Infinite also helped the bank do a strategic overhaul of the Rewards Program, aimed at substantially boosting revenue.

This innovative solution garnered industry recognition and awards.

To expand its impact, the bank also invested in a new fintech partnership focused on scaling this solution across other banks.

Infinite is the chosen partner of Fintech to expand and further onboard additional banks and merchants, highlighting the broad market acceptance and scalability of their integrated payments and rewards solution.

Business Outcomes

New Fintech

Bank diversified Programmable Payments solution to a new Fintech who will focus on taking this solution to other banks.

1900+

additional merchants were onboarded by the bank.

Dashboard & Reporting

Dashboard & transaction related reporting allowed the Bank real time monitoring and alerting of all applications – Debit processor, Switch, Rewards Partner and Core Banking platform.

Diverse Application Response Times

Address industry-standard round-trip SLAs.

Future-Proofing for Funding Sources

Adaptability and future-proofing funding sources for example a line of credit.

Compliance

Adhere to federal mandates - Temporary Overdraft etc.