Reimagining AI-First Insurance

Engage. Predict. Adapt.

Engage. Predict. Adapt.

An Approach to THRIVE IN AN AI-DRIVEN WORLD

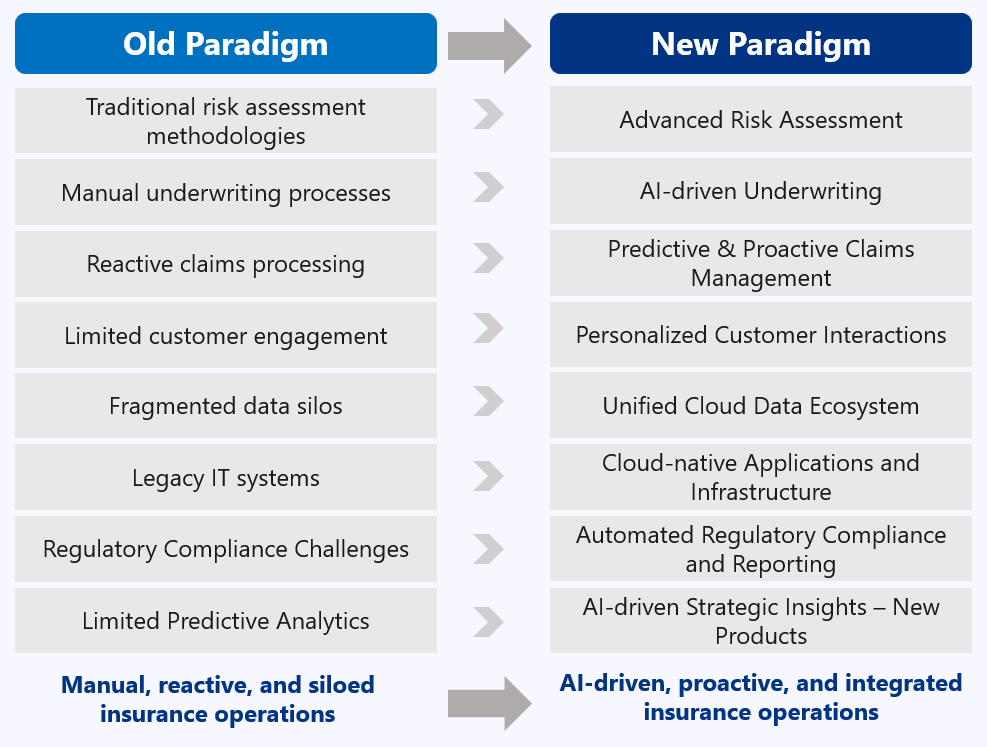

Harnessing AI’s potential in insurance isn't just about automating processes — it's about anticipating risks with precision.

“Infinite leads the charge in leveraging AI, data analytics, cloud infrastructure, and digital technologies to reshape every facet of the insurance industry.

Our integrated approach drives efficiency, accuracy, and innovation across all functional areas.”

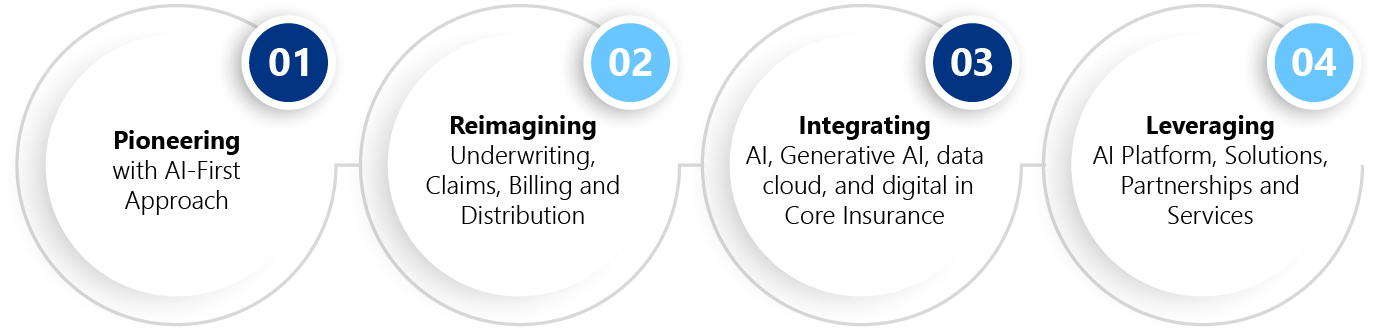

Driving Innovation and Efficiency with the AI-First Revolution

AI’s role in insurance unfolds across two interconnected dimensions

- Enhancing Digital Experiences: AI enables personalized interactions, real-time insights, and seamless service delivery.

- Proactive Risk Management: AI systematically analyzes data to predict and mitigate risks, empowering insurers to manage underwriting, detect fraud, and optimize pricing more effectively.

- Self-Service Capabilities: Enable customers with self-service capabilities and personalized insurance solutions.

- Personalized Insurance: Tailor insurance solutions based on individual behavior and risk profiles using AI-driven pricing models.

- Simplified Policy Explanations: Simplify policy explanations through GenAI/NLP to reduce disputes and complaints.

- Proactive Customer Service: Offer proactive customer service with predictive maintenance alerts.

- Enhanced Customer Satisfaction: Improve satisfaction and NPS through AI-driven retention strategies.

- Streamlined Decision-Making: Equip underwriters, brokers, and agents with AI tools to streamline decision-making and improve productivity.

- Accelerated Underwriting: Accelerate underwriting processes and enhance accuracy with AI tools.

- Automated Data Collection: Automate intake submission processes to streamline data collection and improve underwriting efficiency.

- AI-Driven Risk Assessment: Utilize AI-driven loss run insights to analyze historical claims data and assess risk more accurately.

- Lead Scoring and Compliance: Efficiently score leads and ensure compliance with prioritized leads and adherence checks.

- Conversational AI Support: Enhance sales effectiveness with conversational AI support for agents.

- Optimized Renewal Strategies: Optimize renewal strategies and timing using AI-driven insights.

- Operational Efficiencies: Optimize operational efficiencies across the insurance value chain using AI-First solutions.

- Streamlined Claims Processing: Streamline claims processing and reduce fraud losses with AI automation.

- AI Agentic Capabilities: Efficiently process documents and manage compliance using AI Agentic capabilities to extract and verify information.

- Historical Claims Analysis: Analyze historical claims data (loss runs) to identify patterns, trends, and risks, which helps in assessing new claims more accurately and efficiently.

- Real-Time Sentiment Analysis: Analyze real-time customer sentiment to improve NPS and service quality.

- AI-Driven Insights: Innovate insurance products through AI-driven insights to meet evolving market demands.

- Accelerated Innovation Cycles: Accelerate product innovation cycles with AI-driven simulations.

- Market and Regulatory Analysis: Conduct in-depth market and regulatory analysis to guide strategic product development.

- Ethical Actuarial Models: Develop ethical and compliant actuarial models for pricing accuracy.

- Product Refinement and Churn Prediction: Continuously refine products and predict churn using AI insights.

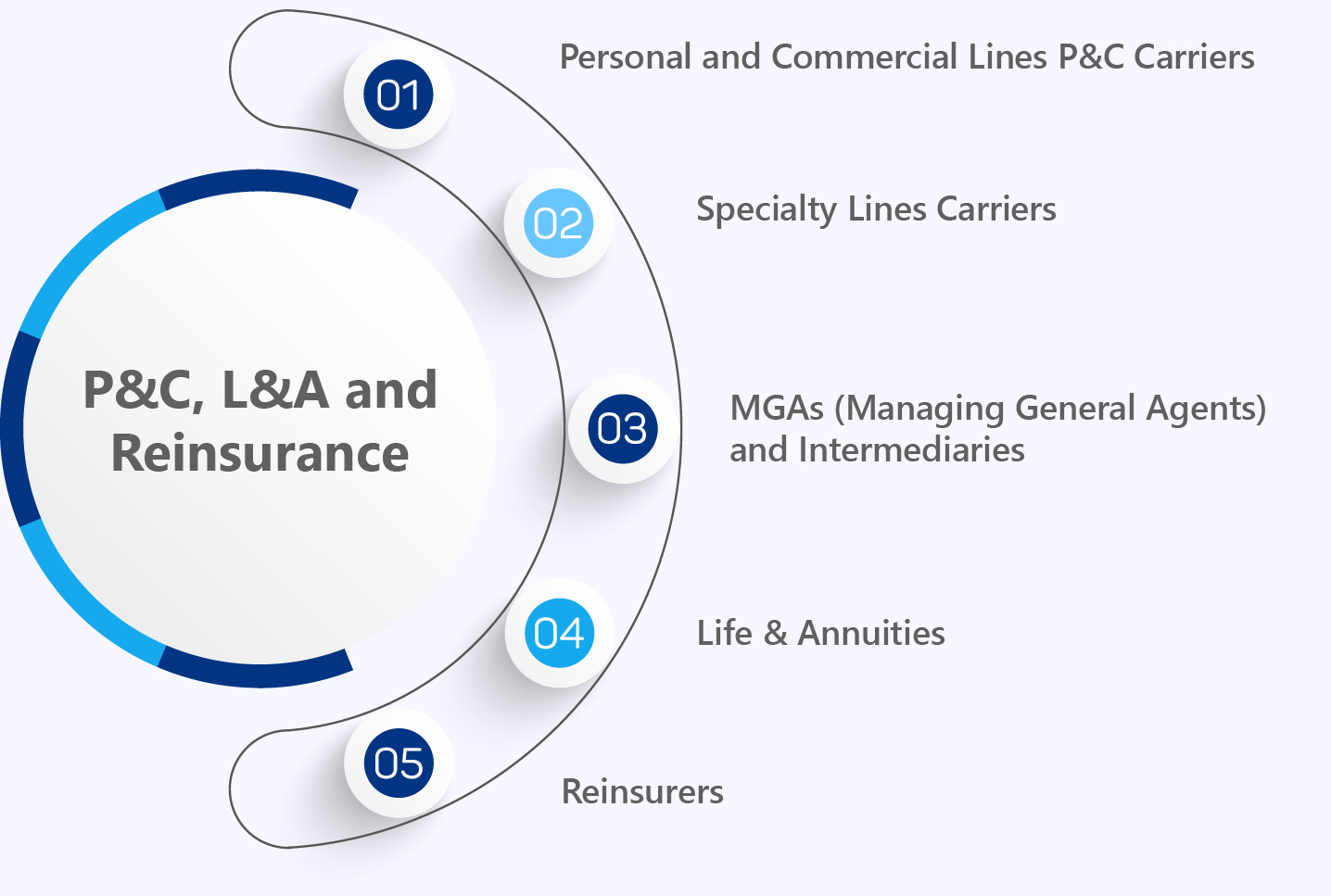

Segments

AI-Driven Solutions for Personal and Commercial Lines Insurance

In the realm of Personal and Commercial Lines insurance, our AI-driven technology solutions are designed to address the complexities of underwriting and the demands of regulatory compliance.

More

In the realm of Personal and Commercial Lines insurance, our AI-driven technology solutions are designed to address the complexities of underwriting and the demands of regulatory compliance. Leveraging advanced machine learning algorithms and generative AI capabilities, we offer AI-powered underwriting solutions that enhance accuracy and efficiency in risk assessment, allowing insurers to make data-driven decisions swiftly and with confidence.

Our digital transformation services streamline processes, from policy issuance to claims management, optimizing customer experiences through intuitive digital interfaces and automated workflows. Data-driven insights derived from extensive analytics empower insurers to personalize offerings, forecast trends, and segment markets effectively.

Cloud-driven transformation ensures scalability and security, enabling seamless integration of new technologies while meeting stringent regulatory requirements.

Less

AI-Driven Solutions for Specialty and Brokerage Lines

For Specialty insurers and brokerage firms, our integrated AI solutions help manage diverse and high-risk portfolios across specialized markets.

More

For Specialty insurers and brokerage firms, our integrated AI solutions help manage diverse and high-risk portfolios across specialized markets. By seamlessly integrating disparate systems and applications, we enhance data accessibility and collaboration, enabling brokers to deliver tailored solutions efficiently and with agility.

Blockchain technology plays a pivotal role in ensuring transparency and security in transactions, which is vital for managing complex claims processes and implementing smart contracts effectively. Predictive analytics powered by robust data insights enable proactive risk management strategies, helping insurers anticipate market shifts and optimize underwriting decisions.

Our cloud-driven solutions facilitate the deployment of scalable infrastructure, supporting continuous innovation and compliance with regulatory standards in a dynamic marketplace.

Less

AI-Driven Transformation for Life and Annuities Providers

AI-Driven Solutions for Reinsurers

By integrating AI, digital, data, and cloud-driven transformations, we enable reinsurers to navigate competitive landscapes confidently while delivering value and innovation to their clients worldwide.

LessInfinite AI-First Solutions for the Insurance Industry

Al-Powered Claims Processing

Personalized Marketing and Product Recommendations

Al-Powered Underwriting

Al-Powered Customer Experience

Fraud Detection and Prevention

Select Areas & Capabilities

- Advanced Risk Modeling: Generative AI enhances predictive modeling by generating synthetic data to simulate diverse risk scenarios and improving underwriting accuracy.

- Automated Decision Support: AI-driven insights from Generative AI models empowers underwriters to make faster, more informed decisions, optimizing risk evaluation processes.

- Data-Driven Risk Assessment: Real-time analysis of diverse data sources enables underwriters to access actionable insights, enhancing both speed and accuracy in risk assessments.

- Predictive Modeling: Machine learning models forecast claim frequency and severity, enabling proactive risk management strategies.

- Scalable Cloud Solutions: Cloud-based platforms ensure seamless data integration real-time access to critical information, and decision-making capabilities.

- Fraud Detection and Prevention: AI continuously monitors transactions and claims, detecting anomalies and suspicious patterns to prevent fraudulent activity.

- Customer Engagement and Support: AI personalizes product recommendations and evaluates tenant or homeowner risks, enhancing both customer satisfaction and informed decision-making.

- Safety and Security Integration: AI integrates dash cam data and provides real-time safety alerts, and driver behavior analysis, reducing risk for policyholders. Integration with dash cam and telematics data enables real-time safety alerts and driver behavior analysis, reducing risk for policyholders.

- Virtual Inspections and Assessments: AI and augmented reality (AR) technologies support remote property inspections, streamlining the underwriting process and minimizing the need for physical site visits.

- Automated Claims Adjustment: Generative AI automates complex claims adjustment tasks, improving accuracy while significantly reducing processing time.

- Cloud-Based Document Management: Secure cloud native platforms simplify document storage and retrieval, ensuring accessibility and compliance during claims handling.

- Fraud Detection and Prevention: AI continuously analyzes transaction patterns and claim histories, detecting anomalies and suspicious behavior to prevent fraud in real time.

- Predictive Analytics for Claims: Machine learning models predict claim frequency and severity, enabling insurers to proactively manage claims and allocate resources effectively.

- Real-time Data Integration: Integrating real-time data enhances claims processing speed and accuracy by providing up-to-date information.

- Customer Engagement and Support: AI-driven chatbots and virtual assistants guide customers through the claims process, enhancing satisfaction and efficiency.

- Safety and Security Integration: Telematics and other safety-related data sources enhance claims assessments, ensuring accurate and fair evaluations.

- Virtual Inspections and Assessments: AI and AR technologies enable remote inspections, reducing the need for on-site visits and accelerating claims resolution.

- Personalized Customer Interactions: Generative AI analyzes customer behavior and preferences to personalize interactions, driving higher customer satisfaction and long-term retention.

- AI-Enhanced CRM: Integrated CRM systems powered by Generative AI predict customer needs, optimize service delivery, and foster long-term customer relationships.

- Customer Data Insights: Secure cloud infrastructure provides real-time access to enriched customer data, enabling personalized marketing and service strategies.

- Chatbots and Virtual Assistants: AI-driven virtual assistants deliver instant, 24/7 support, improving engagement and reducing response times.

- Behavioral Analytics: AI identifies customer behavior patterns to provide insights for personalized marketing and service strategies.

- Sentiment Analysis: AI evaluates customer feedback and communication tone to measure sentiment, and inform continuous service improvement.

- Predictive Customer Behavior: AI models forecast future customer actions, enabling proactive engagement strategies.

- Real-time Data Integration: AI interprets real-time customer data from multiple sources, enabling precise and responsive personalized interactions.

- Customer Lifetime Value Prediction: AI predicts the long-term value of customers, helping to prioritize engagement efforts.

- AI-Driven Billing Automation: Generative AI automates billing processes, generating personalized invoices and payment schedules based on customer data and preferences.

- Enhanced Fraud Detection: AI algorithms identify anomalies and suspicious patterns in billing activities, thereby protecting insurer revenues by preventing fraud.

- Cloud-Based Payment Security: Secure cloud-based payment gateways ensure reliable, compliant transactions, while enhancing transparency for customers throughout the billing cycle.

- Predictive Payment Analytics: AI analyzes payment behaviors and trends, enabling proactive management of billing and collections.

- Customer Payment Insights: AI examines payment data to provide insights into customer payment preferences and habits, improving billing strategies.

- Automated Reconciliation: AI automates payment reconciliation with invoices, reducing manual errors and administrative workload.

- Real-time Payment Monitoring: AI monitors transactions in real time, sending instant alerts for any discrepancies or issues.

- Personalized Payment Plans: AI customizes payment plans based on individual customer profiles, offering greater flexibility and improving customer satisfaction.

- Integrated Payment Platforms: Cloud-based platforms integrate multiple payment methods and gateways, simplifying the billing process.

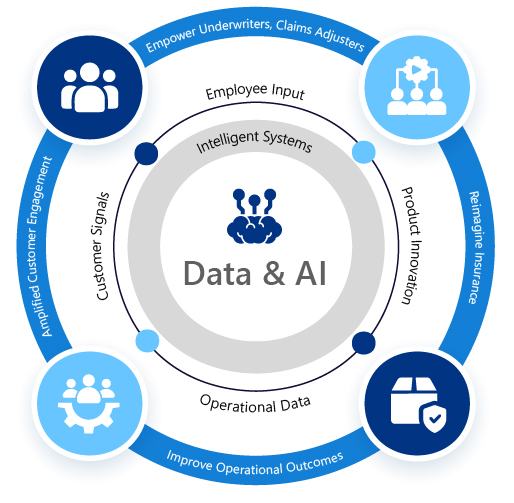

Empowering AI-driven transformation for Insurance Carriers through our comprehensive offerings

Explore how Infinite's tailored solutions drive AI-led digital transformation in insurance

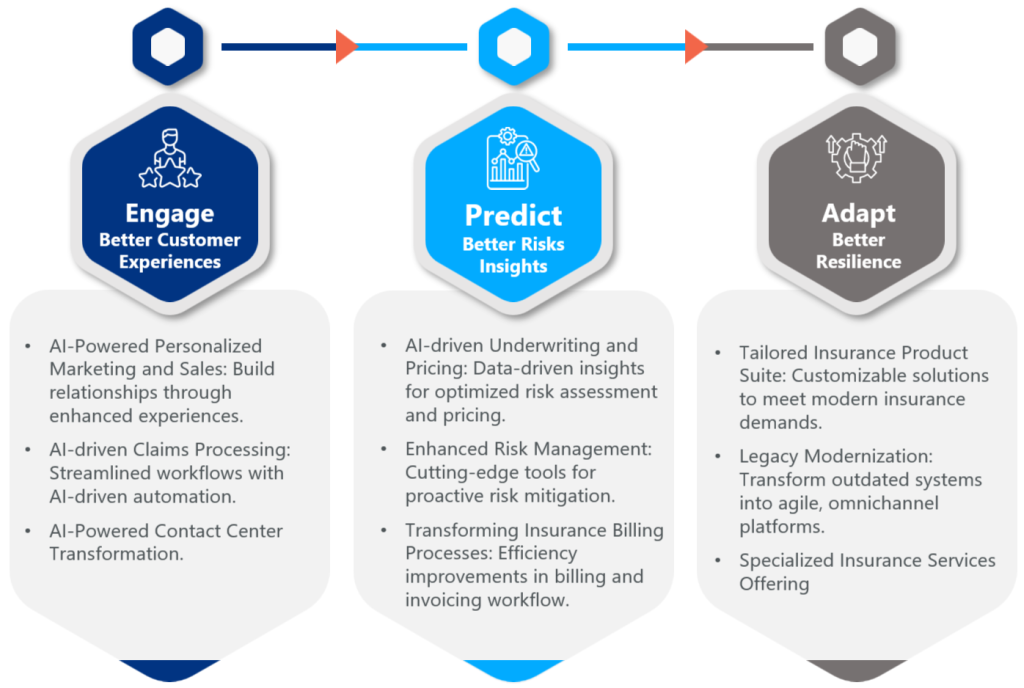

Better Customer Experience

Better Risk Insights

Better Resilience

Amplified Customer Engagement

Reimagined Underwriting and Claims

Proactively Managed Risks

Continuously Improved Operations

Accelerated Innovation Adoption

Engage

Predict

Adapt

Better Customer Experience

Engage

Amplifies Customer Engagement

Reimagined Underwriting and Claims

Better Risk Insights

Predict

Proactively Managed Risks

Better Resilience

Adapt

Continuously Improved Operations

Accelerated Innovation Adoption

Capabilities

Capabilities enabling better experiences, better insights, better resilience

Tailored Insurance Product Suite

Customizable solutions to meet modern insurance demands.

AI-driven Claims Processing

Streamlined workflows with AI-driven claims automation.

AI-driven Underwriting and Pricing

Data-driven insights to optimize risk assessment and pricing.

CRM Integration for Customer-Centric Experience

Enhancing customer interactions through seamless CRM integration.

Transforming Insurance Billing Processes

Efficiency improvements in billing and invoicing workflows.

Insurance Specific AI Models for Enhanced Risk Management

Cutting-edge tools for proactive risk mitigation.

Specialized Insurance Services Offering

AI-powered operational excellence across insurance lifecycle

Legacy Modernization

Transforms outdated systems into agile, omnichannel platforms focused on customer engagement.

Join the AI Revolution in Insurance with capabilities enabling better experiences, better insights and better resilience

- Proactively Managed Risks

- Continuously Improved Operations

- Reimagined Underwriting and Claims

- Accelerated Innovation Adoption

- Amplifies Customer Engagement